sales tax rate in tulsa ok

Oklahoma State Sales Tax. You can find more tax rates and allowances for Tulsa County and Oklahoma in the 2022 Oklahoma Tax Tables.

Taxes Broken Arrow Ok Economic Development

Depending on local municipalities the total tax rate can be as high as 115.

. For vehicles that are being rented or leased see see taxation of leases and rentals. Has impacted many state nexus laws and sales tax collection requirements. Rates and Codes for Sales Use and Lodging Tax 1912 Bristow 4 to 5 Sales and Use Increase July 1 2021 5805 Commerce 4 to 3 Sales and Use Decrease July 1 2021.

Sales Tax and Use Tax Rate of Zip Code 74117 is located in Tulsa City Tulsa County Oklahoma State. The Oklahoma state sales tax rate is currently. There are a total of 355 local tax jurisdictions across the state collecting an average local tax of 3201.

The state sales tax rate in Oklahoma is 4500. Oklahoma Sales Use Tax Information. The December 2020.

Sales Tax and Use Tax Rate of Zip Code 74116 is located in Tulsa City Rogers County Oklahoma State. To review the rules in. 16 rows The Tulsa County Sales Tax is 0367.

The average local rate is 443. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4242 on top of the state tax. The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales tax.

State of Oklahoma - 45. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax. The Tulsa County Sales Tax is collected by the.

This is the total of state county and city sales tax rates. Estimated Combined Tax Rate 487 Estimated County Tax Rate 037 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount None. 2 State Sales tax is 450.

The County sales tax rate is. Estimated Combined Tax Rate 852 Estimated County Tax Rate 037 Estimated City Tax Rate 365 Estimated Special Tax Rate 000 and Vendor Discount None. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

The current total local sales tax rate in Tulsa County OK is 4867. Broken Arrow Sales Tax. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

The Tulsa County sales tax rate is. A county-wide sales tax rate of 0367 is applicable. 842 Is this data incorrect.

2 State Sales tax is 450. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65.

This page covers the most important aspects of Oklahomas sales tax with respects to vehicle purchases. Sales is under Consumption taxes. Average Sales Tax With Local.

Tulsa County Sales Tax. The Oklahoma OK state sales tax rate is currently 45 ranking 36th-highest in the US. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a.

Other local-level tax rates in the state of Oklahoma are quite complex compared against local-level tax rates in other states. Sales Tax in Tulsa Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. With local taxes the total sales tax.

Oklahoma state use tax must be paid on tangible personal property purchased and. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. The Oklahoma sales tax rate is currently.

4 rows The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax.

Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11. The average combined tax rate is 893 ranking 6th in the US.

The Oklahoma OK state sales tax rate is currently 45. The Tulsa sales tax rate is. Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037.

Depending on local municipalities the total tax rate can be as high as 115. The 2018 United States Supreme Court decision in South Dakota v.

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Aqua Lily Pad Lake Fun Floating In Water

Sales Tax Relief From Liability In Oklahoma Mcafee Taft

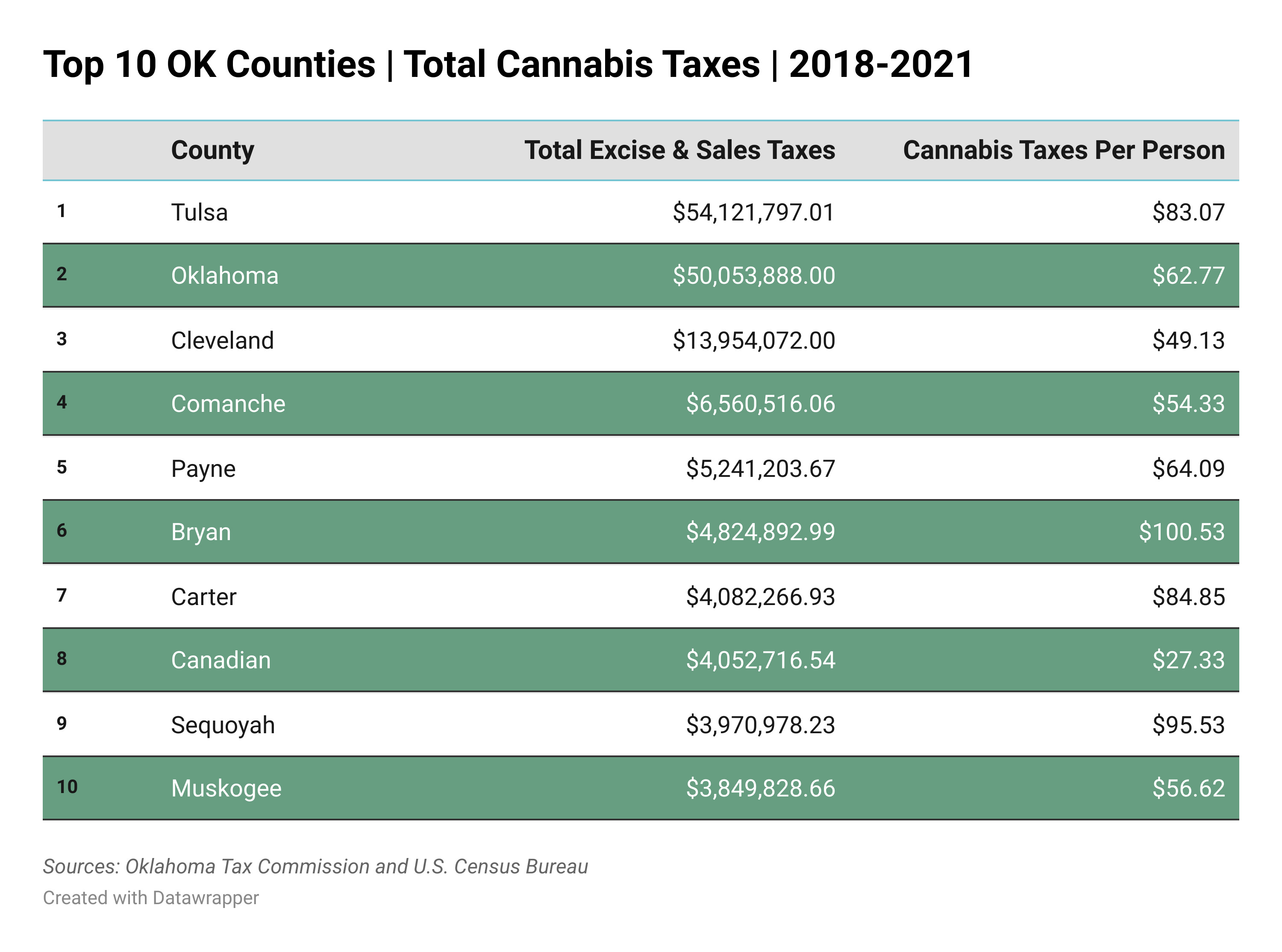

Districts Of Ok Lawmakers Targeting Cannabis Generated 27 5m In New Weed Taxes

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

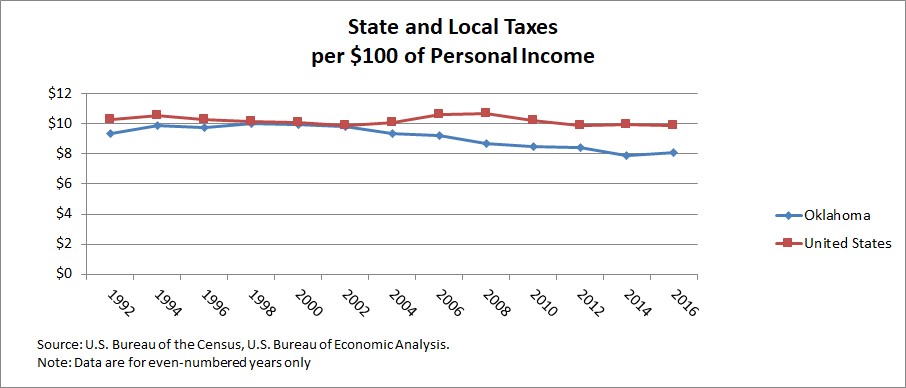

Oklahoma Tax History Oklahoma Policy Institute

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

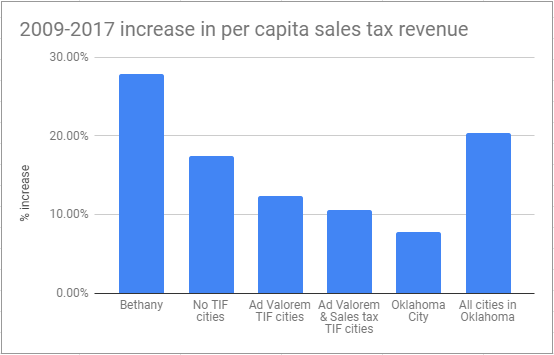

A Study Of Tax Increment Financing Tif In Oklahoma By Chris Powell Medium

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Oklahoma City Sales Tax Revenue Lags Behind Other Cities In Metro

How To Calculate Sales Tax Video Lesson Transcript Study Com

Sales Tax Rates In Major Cities Tax Data Tax Foundation

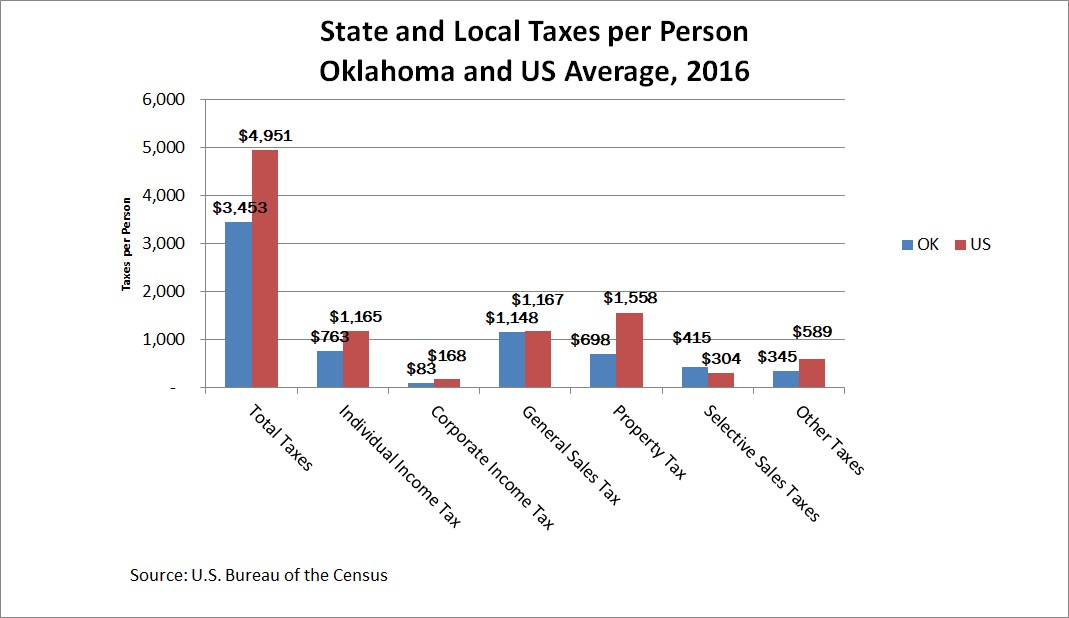

How Oklahoma Taxes Compare Oklahoma Policy Institute

Oklahoma Sales Tax Small Business Guide Truic

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Oklahoma Sales Tax Information Sales Tax Rates And Deadlines

How To Calculate Sales Tax Definition Formula Example